- Download PDF Version available for use with email and print distribution.

To: Business managers and payroll administrators

From: Shannon Wiggins, HR systems manager, Office of Human Resources

As part of the implementation of the Big Beautiful Bill, the Office of Human Resources is updating overtime and holiday pay processes. Please review the following changes carefully and ensure they are applied consistently at your location.

New overtime earning code – FQOT

A new earning code, FQOT (Federal Qualified Overtime), has been created.

Use **FQOT** only when an employee works more than 40 hours in a work week.

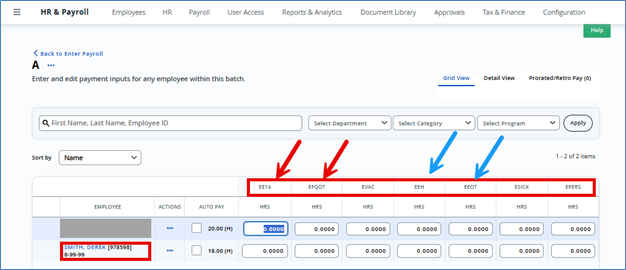

This code replaces the use of EOT for standard weekly overtime.

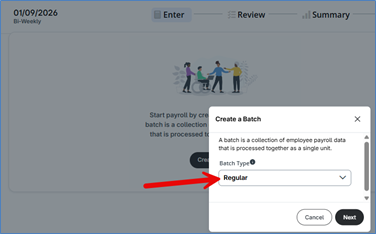

The payroll batch type “Regular” has been updated to include the new code. Please be careful when keying hours in your batch to ensure you are using the correct column/earning code.

Wages paid using this new code will be listed in a separate box on the 2026 W2 form from the regular compensation.

Updated use of EOT for holiday work

The existing earning code EOT (Employee Overtime) is now restricted to holiday-related overtime only

- Use EOT only when an eligible employee works on a holiday for which they also qualify for holiday pay.

- Wages paid using this code will be included with the regular compensation on the 2026 W2 form.

- The payroll batch type “Regular” has been updated so that the EOT code is moved farther to the right, next to the EH Holiday earning code. Please be careful when keying hours in your batch to ensure you are using the correct column/earning code.

Locations using Paylocity Time and Labor

Paylocity has updated the Time and Labor module accordingly. When reviewing your preprocess payroll reports, if you find an error, please contact Paylocity Service at Service@paylocity.com or Shannon Wiggins at swiggins@archatl.com.

Holiday pay eligibility

The following hourly employees are eligible for holiday pay:

- Part-time employees working more than 20 hours per week (PT>20)

- Employee should be scheduled to work 1,040 hours annually or more (20 hours X 52 weeks)

- Full-time employees (FT)

- Employees should be scheduled to work 28.85 hours per week on average = 1,500 hours annually or more.

When the office is closed for a holiday:

- Eligible employees should receive their regular scheduled hours paid as holiday hours using the earning code EH Holiday.

- If an eligible employee works on a day they are receiving Holiday Pay:

- The hours worked must be paid using the EOT earning code.

Action Required

Please review your payroll batch screens closely. The new code has been added as shown below to the Regular batch type in Paylocity. Accurate use of earning codes is essential for compliance with the Big Beautiful Bill.

Please note – we are able to make corrections if you’ve processed a payroll batch using incorrect overtime codes. Please contact Paylocity Service at service@paylocity.com or Shannon Wiggins at swiggins@archatl.com for assistance.

You can also visit IRS.gov or One Big Beautiful Bill Act for more information.